McDonagh Family Office

McDonagh Family Office

Our thesis is technology is the primary driver of global progress. Our focus is on disruptive fields like AI, robotics, energy storage, digital assets and blockchain.We invest in Pre-Seed to Series B technology companies. We hold bitcoin and view it as the ultimate wealth battery.Our team seeks scalable solutions with strong traction, meaningful impact, and defensible moats (network effects, unique commercial dynamics, brand potential).Beyond capital, we actively provide portfolio companies with support across go-to-market, operations, legal, technical, and talent.

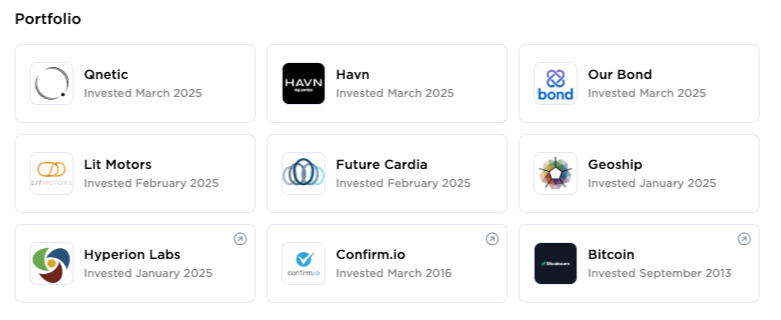

Our Portfolio

McDonagh Family Office invests in early-stage (Pre-Seed to Series B) private technology startups, viewing technology as the primary driver of global change. We focus on disruptive fields like AI, robotics, energy storage, and blockchain.Our vision is a human-first future, powered by technology and data-driven insights.Our Team Adds These Technical Capabilities:

1) Data science

2) Data engineering

3) Revenue operations

4) Python software development

5) Software engineering / app developmentMcDonagh Technologies Investment Profile:

Stage: Seed through Series B

Location: US-only

Check Size: $50K - $300K

Traction: Pre-rev ok; need prototype deployed with users providing feedback.

Why McDonagh Tech: Data science and engineering expert, GTM strategy, background in Investment Banking

Matt McDonagh Biography

Wall Street banker became ML engineer, ₿itcoin nerd and direct investor

Areas of Interest:

• AI/ML

• Bitcoin

• Blockchain

• Wealth Systems

• Private Investing

• Entrepreneurialism

• Revenue Operations

• Python Programming

• GTM Strategy & Systems

Matt McDonagh Biography:

Matt McDonagh is an entrepreneur, investor, author and machine learning engineer living in New York City.Matt is a seasoned Strategy and Operations leader with 15 years of experience driving revenue growth for companies across diverse operating environments. He leverages data, systems, and technology to optimize revenue engines and help companies achieve performance targets.Born in San Diego, California into a 3rd generation military family, Matt moved to Newport, Rhode Island where his dad was a professor to aspiring United States Navy Officers at the Naval War College. Matt graduated from Fordham University with a BS in Business Administration and a minor in Economics.After beginning his career on Wall Street in investment banking, Matt recognized the transformative potential of technology and transitioned into a family office investor focused on data engineering and revenue system development.He is the founder of McDonagh Family Office, which makes strategic investments in tech-enabled companies. Matt actively enhances the value and efficiency of portfolio companies by implementing resource-efficient technologies and data-driven strategies.Matt's technical skills include system design and development, Python programming, SQL, and go-to-market system architecture / development. He is adept at strategic problem solving by focusing on delivering actionable insights, streamlining processes, and fostering alignment across engineering, data, data operations, product, sales, marketing, customer success, and finance teams.

Acceleration Lab

McDonagh Technologies launched an Acceleration Laboratory in 2022 in response to demand from our portfolio companies with limited access to GPUs and other compute, storage and interconnect resources.We were the first family office to fully integrate Artificial Intelligence into our operations.We are currently developing the next generation of artificial intelligence inside our laboratory, with a focus on ML systems designed to increase the operating efficiency and revenue effectiveness of our operations.